Which should companies prioritize: job satisfaction, ease of work, or work performance?

Haruki Ohsawa, CEO of OpenWork Inc., provides commentary in a three-part series of articles on a paper regarding research on the relationship between job satisfaction, ease of work, and corporate performance.

In today’s column, we present the third and final installment of the series, which discusses the interaction between the chicken and the egg.

My name is Haruki Ohsawa, and I’m the CEO of OpenWork, a company that provides a job market platform for job seekers that offers more than 11 million word-of-mouth posts and evaluation scores.

In previous installments in this series, I have explained my research findings and process. You can read those articles through following links.

- Part 1: The HR industry’s “chicken and egg” debate

- Part 2: How to quantify “job satisfaction” and “ease of work”

In this article, I would like to share my thoughts on the results of this research.

Research results in 3 minutes

Although I presented the research results in Part 1, here they are once again.

Here are the definitions of the financial indicators in the figure.

- ROE = Net income/Shareholder’s equity

- Operating profit margin = Operating profit/Net sales

- Dividend payout ratio = Dividend/Net income

- Sustainable growth rate = ROE × (1-Dividend payout ratio) Note: Please view this as the extent to which a company’s profits go to internal investment.

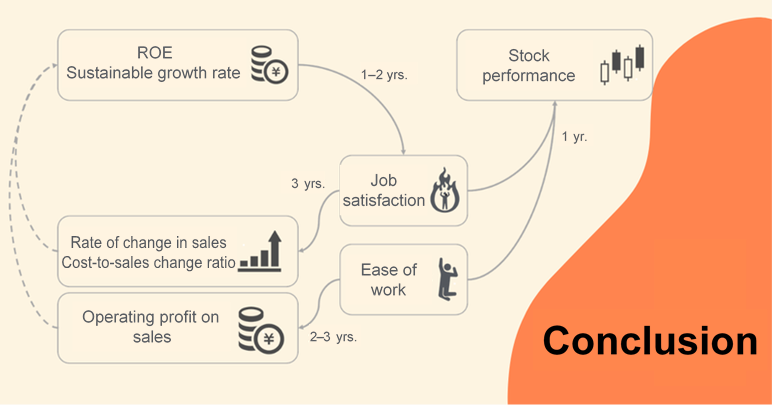

First, let’s look at the impact of job satisfaction and ease of work on corporate finances.

Findings show that improved job satisfaction made a statistically positive contribution to the rate of change in sales and the cost-to-sales change ratio after three years. This suggests that an increase in job satisfaction may be a factor in subsequent corporate growth.

It was also shown that improved working ease made a statistically significant positive contribution to operating profit on sales after two to three years. From this, we could infer that improved working ease leads to lower turnover and stronger hiring power, thus enabling the maintaining of lower labor costs.

Next, let’s look at the impact of corporate finances on job satisfaction and ease of work. Based on the data, there was no strong indication that corporate finances affected ease of work.

The findings, however, did show that improvements in such indicators as ROE and the sustainable growth rate lead to a statistically positive contribution to job satisfaction after one to two years. Since the sustainable growth rate can be viewed as the extent to which a company’s profits go to internal investment, it’s possible that such investment is directed toward new businesses and other various measures, leading to job satisfaction among the company’s employees.

Also, if we break down job satisfaction, ease of work, and stock performance a little more, we get the following results.

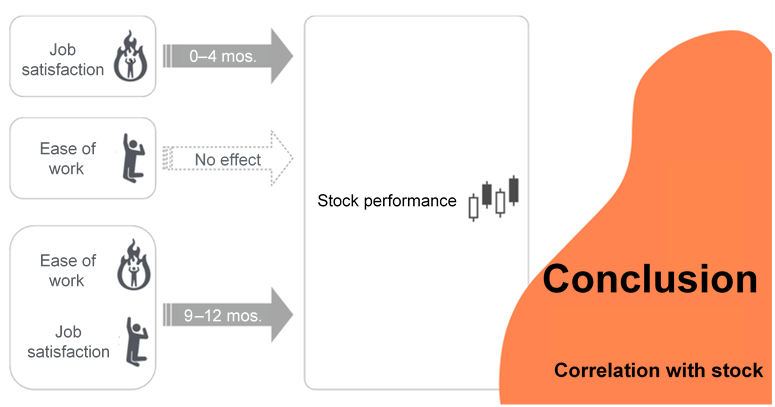

There were some findings related to stock performance that proved a little difficult to correlate.

First, when job satisfaction and ease of work improved, a statistically significant alpha emerged after nine to twelve months. Looking just at job satisfaction, there was an impact on stock performance after a mere zero to four months, but as for the change in the working ease score, there was no evident effect on stock performance.

It’s not hard to grasp why simply improving working ease alone doesn’t affect stock performance. It seems as though it’s only when it is combined with job satisfaction that labor productivity increases.

One question that remains, however, is whether improving job satisfaction alone has an immediate effect on stock performance. Moreover, the time lag of between just zero to four months is difficult to explain. Accordingly, I look forward to further research into this finding.

Conclusion

I’ve written at length on this topic, but how did you like it?

Summary

- Job satisfaction or working ease will affect financial indexes after two to three years.

- Job satisfaction and working ease will also affect the stock price after one year.

- Financial indicators will affect job satisfaction after one to two years.

It may sound like the debate between Igor Ansoff and Alfred Chandler about whether structure follows strategy or strategy follows structure but, personally, I feel that both are important.

As a business manager, it is not enough to just boost business performance or build the organization. I also need to create business that can deliver great value to the world and build an organization in which the corporate culture itself becomes our greatest competitive advantage.

This article was published with the permission of Haruki Ohsawa of OpenWork. It has been partially modified from its original format. The original article (in Japanese) can be viewed here.

Reference:

- Haruki Ohsawa note (in Japanese) “Which comes first in contributing to raising corporate value: work performance or job satisfaction? An AI analysis of more than 11 million employee word-of-mouth company reviews”

- OpenWork is a job and recruitment information platform that utilizes one of Japan’s largest databases of employee reviews

- OpenWork Recruiting is a recruiting platform that provides a direct scouting service.